-

Operated by WORK HARDING HOME MORTGAGE TEAM, LLC

- Loan Status

-

Free Consultations

801-228-0937

- Home

- Loan Services

-

Loan Types

- Mortgages

- Compare Loans

- Fixed-Rate Loans

- Adjustable-Rate Loans

- FHA Loans

- VA Loans

- USDA - Rural Housing Loans

- Utah Housing 0% down Loans

- HomePath Loans

- Reverse Mortgage Loans

- Jumbo Loans

- Lender Paid Mortgage Insurance Loans

- No Closing Cost Loans

- Grant Money Loans

- Construction & Lot Loans

- Doctor Loan

- Investor Cashflow

- Extended Rate Lock Program

- One-Time Close New Construction

- Calculators

- Team Info

- About Us

- Social

- Apply Now

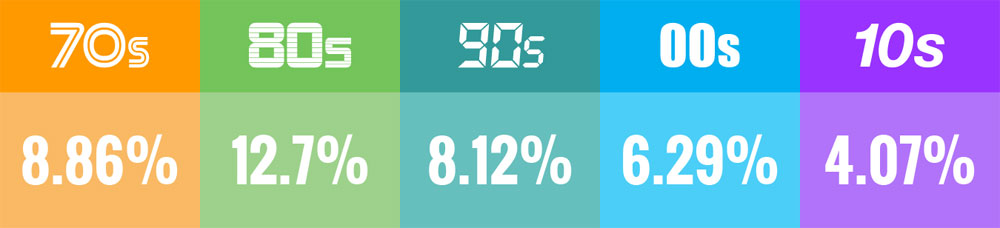

Today's Mortgage Rates

Today's Mortgage Rates