If your goal is to pay off your home, I want to give you some options for doing that.

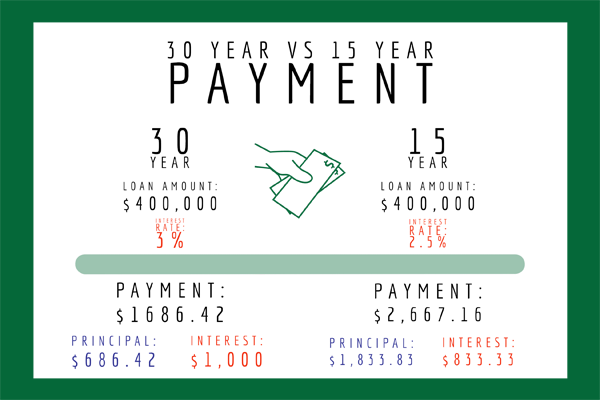

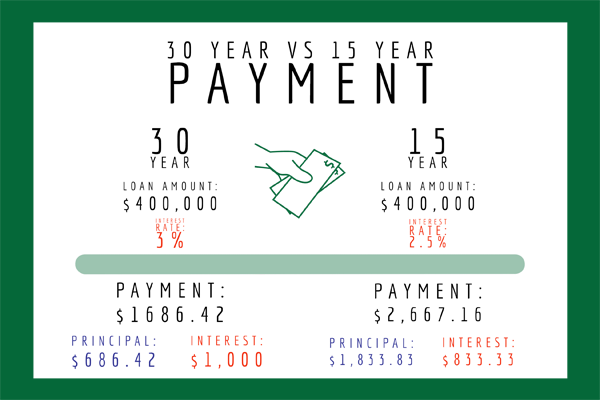

One option is to do a 15 year fixed. The benefit of a 15 year fixed vs a 30 year fixed is that the amount of your payment that goes towards principal is much more. The balance just melts away every month on a 15 year. Another benefit to a 15 year is that the interest rate is typically .50% better than it is on a 15 year, which can add up over time.

One downside of a 15 year is, of course, the higher payment. A lot of people don’t love locking themselves into that higher payment and so they opt for a second option.

Paying extra on your mortgage can yield huge benefits over time. As you make extra payments the interest is reduced and the term of your mortgage goes down.

For example, let's assume we have a $350,000 mortgage at a 4% rate on a 30 year fixed. If you were to pay an extra $150 a month that would save you an estimated 52 months on the mortgage and an estimated $34,214 in interest. That's a lot of savings.

Everyone's situation is different and so for that reason I created a google spreadsheet that has my favorite EXTRA PAYMENT CALCULATOR. If you want to see how paying extra on your mortgage would help you then click the link below to run payment scenarios.

.png)